Get the Facts Here

YOUR MOST TRUSTED SOURCE OF INFORMATION ON THE NOV. 16TH VOTE.

ABOUT

On November 16, 2021 our community will have the opportunity to vote for the future of Moody. The proposed Ad Valorem Increase will provide for a wide array of critical capital improvement projects for our schools that will support our children for years to come.

Community Testimonials

VOTE FOR MOODY

THE OFFICIAL SOURCE OF INFORMATION ON YOUR UPCOMING OPPORTUNITY TO VOTE FOR MOODY SCHOOLS.

AN AD VALOREM INCREASE. WHAT TO KNOW,

AT A GLANCE

Overcrowding

Moody schools and St. Clair County Schools continue to grow each year by an average of 1.5%.

Limited space and classrooms available at both MJHS and MHS.

The current population of MJHS is nearing 400, and MHS is over 700.

Both buildings are beyond the expected capacity for when they were built.

The number of needed PreK Classes has tripled in the last 5 years

Outdated Facilities

Outdated science facilities limit instruction and learning

Updates are needed to include STEM, with flexible, collaborative spaces

Fine Arts are limited due to inadequate space and facilities

Additional space and resources are needed for band, theater, and performing arts and expanded class offerings such as media production and graphic design

Limited Availability of Local Funds

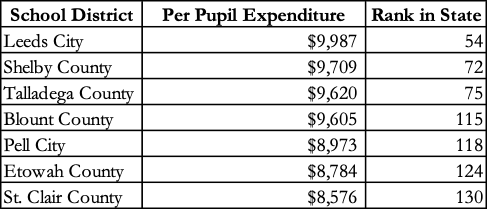

·Amount of money available to spend per student

(Includes state, federal, and local funding)

·

• Rank 130 (of 138) in spending per pupil

• Includes state, federal, and local funding

• Local funding (property tax) = $9,826,127

• Spending per pupil = $8,567

• **Based on 2018 federal report card data

St. Clair County currently has a property tax

of 13.5 mils (one of lowest in state)

The Solution. An Ad Valorem Increase

The Moody Attendance Zone is proposing an additional 15 millage (mils) of property tax for capital projects.

Only residents in the Moody school attendance zone would be eligible to vote for the ad valorem increase in Moody Schools.

Property Taxes AKA – ad valorem taxes

What is a Mil?

1/10 of one cent

Ten cents on each $100 of assessed value (AV) of taxable property (OR $1 for every $1000 of AV)

Tax on a property (real or estate) as determined by an assessor

Based on the value of the owned property or land

Residential homes are assessed based on the fair market value (mailed to you each year)

Commercial and farm properties are not exempt from the tax.

They are NOT assessed the same as residential properties but at CURRENT USE TAX.

A Powerful, Comprehensive Impact

See all that we can accomplish

Overcrowded No More.

The Ad Valorem Increase would allow for the construction of a brand new, state of the art high school, a new Performing Arts Center, and renovations and additions to existing facilities.

The high school would be built to house 850 students with a future wing to handle 1000 students.

The existing high school will be renovated to a junior high school that would house grades 6th through 8th, have own cafeteria, and competition gym.

Moody Middle School would include grades 4th, 5th, and PreK program (currently 6 classes)

Moody Elementary would house grades Kindergarten through 3rd.

School Improvements: Moody Elementary School

Remodeling of the entry way

Renovate floor tile and walls

Update playgrounds

Add air conditioning to gyms

Update computer labs and Intervention areas

School Improvements: Moody Middle School

Install outdoor PE facility/playground area behind school

ADA compliant playground for special needs students

Outdoor classroom

STEM lab

School Improvements: Moody Junior High

•Renovate existing Moody High School

•Remodel front office/lobby to include “lobby area” and second partition of doors

•Update library to a media center

•Outdoor amphitheater space

•Create 2 science labs

•Encase walkway from school to lunchroom

•Install new gym bleachers and refinish gym floor

THE NEW MOODY HIGH SCHOOL

21st Century STEM and science labs with robotics area

Competition gymnasium

Location for band that accommodates entire band including large and small group ensemble areas

Agriculture Science, Family and Consumer Science, and Business electives in building

Cafeteria

Bus access road

Fitness and workout areas for PE that are unisex

Modern media center with cyber café

“Green” room for media publication with recording studio

Additional Student Resources

New Performing Arts Center that could be used by all schools. This will improve the fine arts education program.

2,000 seat auditorium, sound stage, sound system, and orchestra pit

Upgraded band areas in the new high school, there would be a dramatic improvement in how fine arts could be offered.

Each school would also receive areas that focus on improvements in academics:

Up to date science labs, STEM, and robotics spaces

Outdoor classrooms

Collaboration/Breakout spaces

Media Productions and green room

Improved media centers

Flexible classroom teaching arrangements

The installation of turf to Bill Morris stadium field that will allow for more year round use by athletic teams and other student and community organizations.

FAQs

1. How much will a 15 millage increase cost?

a. The property (ad valorem) tax is based on the assessed value of your taxable property. The 15 millage is an additional increase from the 13.5 millage rate currently collected that is dedicated for St. Clair County Schools.

b. The assessed value of the property is determined annually by the St. Clair County property appraiser.

c. This would increase the overall property tax value collected and dedicated for St. Clair County Schools to 28.5 mils. 13.5 millage would continue to St. Clair County Schools, but the 15 millage increase would only be allowed to be used in the Moody Schools attendance zone.

d. A millage is ten cents ($0.10) on each $100 of assessed value of taxable property, or $1 for every $1000 of assessed value.

e. For example, a home with an appraised value of $200,000 would have an increase in property tax of $300 annually or $25 monthly. You can see the property tax increase matrix at 15 millage for the additional tax increase that would be dedicated to Moody schools.

f. The home assessed value is taxed at the fair market value, but other properties, such as businesses, farms, etc are taxed at the current use. Contact the St. Clair County Revenue department for the exact tax for your property.

2. Why do we need to increase the property tax?

a. The major issue facing the Moody schools is overcrowding. The current population of MJHS is nearing 400, and the high school is over 700. The overcrowding of these buildings makes it difficult in the halls and classrooms. Both buildings are beyond the expected capacity for when they were built.

b. Over the last 10 years, the enrollment in Moody schools has grown by 341 students. The number of students increased from 2,182 in 2009 to 2,523 in 2019.

i. The school enrollment growth rate mirrors the growth in the city of Moody as the city population has grown from 8,000 in the year 2000 to over 13,000 in 2020.

ii. Both city population and student enrollments continue to grow, and the number of new students in Moody schools increases by approximately 35 each year.

c. The second issue is the lack of funding. St. Clair County Schools does not get an expansive budget from the Alabama State Department of Education for capital projects. In other systems, these funds come largely from local property taxes. In fact, based on the 2018 federal report card, St. Clair County Schools ranks 130 out 138 school systems in terms of per pupil spending (because of the lack of money from property taxes) at a rate of $8,567 per student. Here are how other systems have been able to fund quality resources based on the per pupil spending:

d. We are already improving in achievement areas each year based on test scores and Alabama State Department of Education report card data, could you imagine what would happen if we were able to give our students the space and structures that they deserve?

3. What would the increased taxes be used to purchase?

a. The money would be used for capital projects only, which includes the construction of new buildings and renovating existing structures.

b. Because we would use the passing of the property tax to receive a bond, we would have to tell the lender how the money would be used to secure the loans necessary to move forward.

c. The funds from this property tax increase would only go to capital projects in the Moody schools.

d. The need to supply the lender with specific long-term plans for the funds is one reason why the proceeds cannot be used for adding more local teaching units or other purposes.

4. What household areas does this tax include?

a. The only people that would vote for a tax increase for the Moody schools are residents in the Moody schools attendance zone. If the home is zoned for any Moody school, your vote would only affect Moody.

b. Even if other districts vote no, the Moody school zone residents could vote yes and receive the tax money for capital projects.

c. This money would legally only be allowed to fund capital projects in Moody, and it could not be used in any other school zone.

d. Students that are approved to attend Moody schools that are not zoned to Moody now have to be approved to transfer and must pay $1,500 yearly. This was approved by the St. Clair County Schools last year.

5. When and how would I pay the tax?

a. Beginning February 2022, the tax would be assessed. For most Moody residents, it will be wrapped in the escrow payments of their mortgage.

b. By passing the tax, we would be able to show we would have the funds and we could leverage it for a bond immediately. New construction could begin shortly after a certified election.

6. What is our property tax in comparison to surrounding school systems?

a. Trussville City Schools – 43

b. Shelby County Schools – 33

c. Jefferson County Schools (not including larger municipalities) - 32

d. Leeds City Schools – 31

e. Calhoun County Schools – 24

f. Talladega County Schools – 21

g. Pell City Schools – 13.5

h. Moody School Attendance Zone – 13.5 (currently), 28.5 (with proposed increase)

7. How will it be ensured that the property tax only goes to Moody schools?

a. The tax money would only be allowed to fund capital projects within the Moody school attendance zone. It is illegal for any of the levied tax to be spent anywhere else.

b. The St. Clair County Board of Education will create an account with the money. Since it is public funds, the account will be presented at monthly board meetings.

8. How does the property tax process work?

a. After the Moody school attendance zone is finalized, the St. Clair County Board of Education will accept a petition signed by 50 residents in the zone to put forth a special election. The Board of Education will then proceed to acquire a resolution from the St. Clair County Commission to allow the residents to vote in an election. It would have to be a called special election by the commissioners for it to happen this year. If the residents vote “yes” and the election is certified, the Board of Education can use the vote to pursue a bond that will allow for the capital projects to begin immediately.

b. The vote would be for property taxes to increase by 15 millage for a total of 30 years. It would have to be voted on again after 30 years.

c. The property tax would not be assessed until February 2022.

9. How will it be ensured that Moody schools will still get equal money from St. Clair County Schools?

a. The St. Clair County Board of Education is committed to continuing any maintenance to buildings and parking lots regardless if a community passes a property tax. The Board of Education will be responsible for continuing to maintain the buildings and providing resources just as it had previously done. This includes items like maintaining roofs, lights, and equipment, paving, and updated classroom technology.

b. Funds and expenses are discussed at each monthly board meeting. The minutes are posted on the SCCBOE website, and the meetings are streamed live on YouTube. The money allocated for each school will be public information.

c. Funds allocated by the Alabama Department of Education for things like teaching units, technology, and library improvements are based on the number of students in the school. These funds must go to the local schools, and it is reported publicly each year.

d. The St. Clair County Board of Education will request an attendance zone representative to come to all meetings to see the tax budget expenses and income.

10. What will all four Moody schools hope to receive?

a. This is a wish list put together by the principals at each school. The number of projects depends on the funds available.

b. Each school will have jobs completed using a combination of the proposed debt consolidation funds (voted on by SCCBOE in February) and the property tax funds.

c. Moody Elementary School:

i. Remodel the entry way

ii. Renovate floor tile and walls

iii. Update playgrounds

iv. Add air conditioning to gyms

v. New digital sign

vi. Update computer labs

d. Moody Middle School:

i. Roof is already being fixed by SCCBOE this year using current district funds.

ii. Install outdoor PE facility/playground area behind school including equipment, fencing, and basketball court

iii. ADA compliant playground for special needs students

iv. Outdoor classroom

v. STEM lab

e. Moody Junior High School:

i. Renovate existing Moody High School for relocation of MJHS

ii. Remodel front office to include “lobby area” and secure entry with second set of doors (similar to the current entry way at MMS)

iii. Update library to a media center

iv. Outdoor amphitheater space

v. Create 2 science labs

vi. Encase walkway from school to lunchroom

vii. Install new gym bleachers and refinish gym floor

f. Moody High School:

i. New construction - see renderings

ii. Will include a community Performing Arts Center

iii. Will include separate cafeteria and a competition gym

11. Can this money only be used for capital projects?

a. Because the St. Clair County Board of Education must account for how the money will be spent prior to a financial institution issuing a bond, it has been determined that money would best be spent on capital projects. Thus, all funds raised with the property taxes will be used for the wish list capital projects.

12. How will academics be improved by building/renovating schools?

a. Overcrowding:

i. Outside of upgrading the facilities and learning spaces at all schools, the major issue that is fixed with these capital projects is the overcrowding of schools.

ii. The high school would be built to house 850 students with the ability to expand into a future wing to handle 1000 students.

iii. The new junior high school would be able to house grades 6th through 8th.

iv. This change would allow the rapidly growing PreK program to be shifted to Moody Middle School (grades 4th, 5th and PreK).

v. There are currently 6 PreK classes which has tripled in the last 5 years, and there are plans to add additional classes when space is available.

vi. Moody Elementary would house grades Kindergarten through 3rd.

c. Academic resources:

i. One of the major improvements that would occur is the building of a Performing Arts Center that could be used by all schools. This will improve the fine arts education, and with the upgraded band areas in the new high school, there would be a dramatic improvement in how fine arts could be offered.

ii. Each school would also receive improvements in areas that focus on science and math with either science labs, outdoor classrooms, or STEM spaces for students. This will create unique learning areas and experiences that will bring students into the 21st century and develop skills that will help them succeed in any post-secondary career.

13. When would a new high school be available?

a. If the tax is passed prior to February 2022, a new school would take approximately 2 years to properly build.

b. Currently owned property by St. Clair County Schools would be used to build the new high school, so there would be no additional cost to purchase property.

c. In the best-case scenario, a new Moody High School would be available to open August 2024 for the 2024-2025 school year.

14. Why was it decided to build a new high school?

a. Several ideas were discussed for all schools. One idea that was originally discussed was building a new junior high school. We want to be sure that these funds are used to address the needs of all Moody students and all school campuses while being cost-effective. After much discussion and review of the estimates, it was decided that we could earn enough money from the tax to build a new high school and complete all of the projects on the other school campuses without wasting money through rentals.

b. A significant factor in choosing to build a new high school is that if any other school besides a high school was built, the entire school would have to be housed in portable trailers for 2 school years. One trailer cost approximately $80,000 per year, so all classrooms for a total of two school years would cost around $6 million of the property tax just to rent the portable trailers.

c. If a new junior high was built, the band and agriculture science (shop) areas would have to be constructed as an addition to the current high school while also building more classrooms to alleviate the continued overcrowding at the school.

i. This would leave no funding for any of the projects at MES or MMS.

ii. It would eliminate the building of a performing arts center.

15. Who would be allowed to use the Performing Arts Center?

a. The Performing Arts Center could be used by any of the Moody schools for graduations, programs, and performances.

b. It would also be rented to groups in the community that could utilize a space that large.

16. How many seats will the Performing Arts Center hold?

a. 2000 seats are available in the Performing Arts Center. The Performing Arts Center also includes a classroom, multiple dressing rooms, and storage areas.

17. What happens if voters do not approve the property tax?

a. All of the Moody schools will continue as currently structured. Both the high school and junior high school will continue to be overcrowded, and based on population projections, the other schools will also be overcrowded.

b. This will make it difficult for students to have the experiences and learning environments that they deserve to help continue to grow the academics of Moody.

c. Eventually, students will be housed in trailers at all schools for classes if there are no more available classrooms in the buildings.

18. What types of properties are exempt from an ad valorem tax?

a. Residential homes are assessed based on the fair market value, and the other properties are not.

b. Commercial and farm properties are not exempt from the tax. They are not assessed the same as residential properties. Owners of this type of property will need to contact the St. Clair County Tax Assessor for exact values for the property tax increase.

19. What will this do to my property value?

a. In cities that have recently built (since 2017) a new high school, the average property value has increased in every city.

b. The first year after a high school is built, the property values increase by 18% and increase an additional 4% the following year. Based on the property tax data in these cities, property values increased an average of $8,700 from the year before the school was built and $19,000 from two years before the school was built.